Wednesday, November 28, 2012

Squaring price range in prior trend with time in current trend.

Here price range should be calculated first

See high, see low,

Deduct h-low

High 965 on august 2002

low 768.83 on october 10,2002

So difference is 965-768.83= 196.37 convert it into angle = 135 degree

Now 135 degree ke trading day te convert korbo, It will be 36 TD,

So upcomming trend change will be 35 days after now low

See high, see low,

Deduct h-low

High 965 on august 2002

low 768.83 on october 10,2002

So difference is 965-768.83= 196.37 convert it into angle = 135 degree

Now 135 degree ke trading day te convert korbo, It will be 36 TD,

So upcomming trend change will be 35 days after now low

Squaring price that ended a prior trend with time in current trend

Here we will see high and low.

Such as

High swing 31.6 nov 14,2002 convert it into angle =61 degree

we now determine the trading day by formula when it will make square,

convert 61 degree to TD,CD(57, 75) /65,83)

We can assume that on the mentioned day the square will form , and trend will end

lowest swing 22.12 feb 10,2003 convert it into trading day, calender day( 58TD,88CD)

so our assumption is correct.

Such as

High swing 31.6 nov 14,2002 convert it into angle =61 degree

we now determine the trading day by formula when it will make square,

convert 61 degree to TD,CD(57, 75) /65,83)

We can assume that on the mentioned day the square will form , and trend will end

lowest swing 22.12 feb 10,2003 convert it into trading day, calender day( 58TD,88CD)

so our assumption is correct.

Squaring price range of current trend with time of current trend

main theme.

When price and time make an square , It is the great support and resistance .Price and time make square of various way.

Here we first need to see the Range of current trend, We need to see High and low of current trend

Such as current trend down, High 106.73, on march 19,2002, low 71.79 on october 10,2002

So our trading day passed from high to low is 142(march 19,2002-october10,2002)

Here down trend started on march 19,2002, ended on october 10,2002

Trading range High-low(106.73-71.79)= 34.76 near about 35 convert it to degree,It is 120 degree.

now trading day 142= 120 degree

So here trading day makes square with price range of current trend.

So trend will change.

When price and time make an square , It is the great support and resistance .Price and time make square of various way.

Here we first need to see the Range of current trend, We need to see High and low of current trend

Such as current trend down, High 106.73, on march 19,2002, low 71.79 on october 10,2002

So our trading day passed from high to low is 142(march 19,2002-october10,2002)

Here down trend started on march 19,2002, ended on october 10,2002

Trading range High-low(106.73-71.79)= 34.76 near about 35 convert it to degree,It is 120 degree.

now trading day 142= 120 degree

So here trading day makes square with price range of current trend.

So trend will change.

Friday, November 23, 2012

Squaring time in prior trend with price range of current trend

Here three pieces of information needed

Number of trading day or calender day in prior trend or swing

price range of current swing

You can measure a price range from close-close, from high to low or close to high or low.

with this application firstly convert price and time to degree

Steps:

firstly see swing high or low

Secondly convert price or time to TD and Calender day.

thirdly convert TD in to degree.

1- 4 degree seperation or variation is acceptable.

Number of trading day or calender day in prior trend or swing

price range of current swing

You can measure a price range from close-close, from high to low or close to high or low.

with this application firstly convert price and time to degree

Steps:

firstly see swing high or low

Secondly convert price or time to TD and Calender day.

thirdly convert TD in to degree.

1- 4 degree seperation or variation is acceptable.

Squaring price with current trend

high price

Low

Close

Trading day

calender day

Squaring price that ended a prior trend with time in current trend.

Squaring price range with current trend.

For this application U need following information

Price range of prior trend

Number of trading days(TD)

number of counting day(CD) that elapsed in current trend.

Example:

from august 22 to october 10 2002 high to low range(high-low) SPX is 965-786.83= 196.37

convert it to angle 193.37=135 degree

next low to high( up swing) from october 10,2002 here total number of trading days(TD)=36 days

36 TD = 135 degree angle.

How to convert price to trading day or counting days.

formula:

(((2*n) +((2*x)/360)+1.25) square

n= number of rotation,

x= anlge of interest.

Price range of prior trend

Number of trading days(TD)

number of counting day(CD) that elapsed in current trend.

Example:

from august 22 to october 10 2002 high to low range(high-low) SPX is 965-786.83= 196.37

convert it to angle 193.37=135 degree

next low to high( up swing) from october 10,2002 here total number of trading days(TD)=36 days

36 TD = 135 degree angle.

How to convert price to trading day or counting days.

formula:

(((2*n) +((2*x)/360)+1.25) square

n= number of rotation,

x= anlge of interest.

Squaring price with time

Implication

trending data.

At first high , low, trading day of trend changed from high/low, Counting day detect korbo.

secondly we will see closing price, modify it to angle, move 0n 360 circle 0,90,180,270,360

90 degree kore move korbo.

next trading day (TD) degree convert korbo, 4 degree diff accept korbo

Now low price dekbo, angle convert korbo, 90 degree

trending data.

At first high , low, trading day of trend changed from high/low, Counting day detect korbo.

secondly we will see closing price, modify it to angle, move 0n 360 circle 0,90,180,270,360

90 degree kore move korbo.

next trading day (TD) degree convert korbo, 4 degree diff accept korbo

Now low price dekbo, angle convert korbo, 90 degree

Thursday, November 22, 2012

How to convert price or time to ganns angle/Degree

Here is the formula to convert price or time to degree or angle of gann:

Step1 square root of price/time/price range or time in days or time in bar that you wants to convert( Suppose, N= 74)

Step 2 sqrt *180- 225 = 1548.42-225=1323.42

Step 3 result of step2/360 = 3.676

step 4 result of step 4- integer= 3.676-3( Here 3 is integer0

Step 5 result of step 4*360 = .676*360= 243.42

Step1 square root of price/time/price range or time in days or time in bar that you wants to convert( Suppose, N= 74)

Step 2 sqrt *180- 225 = 1548.42-225=1323.42

Step 3 result of step2/360 = 3.676

step 4 result of step 4- integer= 3.676-3( Here 3 is integer0

Step 5 result of step 4*360 = .676*360= 243.42

Time factor for Trend in Ganns

Time factor is the most important factor in ganns

for minor trend change: 3,5,7,911.25,14,14,18,21,24,28,30,35,36,42,45,48,49,54,60,72,90,96 days trend will changed after every mentioned days.

Intermediate trend change: 120,144,180,240,270,288,360 days

Long term trend: 3,5,7,11.25,15,22.5,30,45,60,90 yrs

for minor trend change: 3,5,7,911.25,14,14,18,21,24,28,30,35,36,42,45,48,49,54,60,72,90,96 days trend will changed after every mentioned days.

Intermediate trend change: 120,144,180,240,270,288,360 days

Long term trend: 3,5,7,11.25,15,22.5,30,45,60,90 yrs

Friday, November 16, 2012

Converting time or price to gann Degree

Gann Angles: Basic Explanation

W.D. Gann (1878-1955) developed the use of what he called "Geometric Angles", now commonly referred to as Gann Angles, used to determine trend direction and strength, support and resistance, as well as probabilities of price reversal.

Gann was fascinated by the relation of time (T) and price (P). Gann drew his angles from all significant price pivot point highs and lows. He used just one pivot point to draw an angle that rose (or fell) at predetermined and fixed rates of speed, as follows:

T x P = n degrees

1 x 8 = 82.5 degrees

1 x 4 = 75 degrees

1 x 3 = 71.25 degrees

1 x 2 = 63.75 degrees

1 x 1 = 45 degrees

2 x 1 = 26.25 degrees

3 x 1 = 18.75 degrees

4 x 1 = 15 degrees

8 x 1 = 7.5 degrees

where

T is the number of units of time, graphically plotted on the horizontal x-axis.

P is the number of units of price, graphically plotted on the vertical y-axis.

x is read as "by".n degrees specifies the slope of the Gann angle, measured in degrees.

Translating time by price into degrees assumes a square grid, where one unit of time on the x-axis takes up the same amount of horizontal space as the one unit of price on the y-axis takes up vertical space. For example, 1/16 of an inch might be set to one week of time on the horizontal x-axis, and 1/16 of an inch might be set to one dollar of price on the vertical y-axis. On such a proportionally scaled chart, the 1 x 1 geometric angle, which for every one unit of time rises one point in price, is a 45 degree angle.

Ever wonder how to calculate an angle on WD Gann's hexagon chart? Here is the formula

W.D. Gann (1878-1955) developed the use of what he called "Geometric Angles", now commonly referred to as Gann Angles, used to determine trend direction and strength, support and resistance, as well as probabilities of price reversal.

Gann was fascinated by the relation of time (T) and price (P). Gann drew his angles from all significant price pivot point highs and lows. He used just one pivot point to draw an angle that rose (or fell) at predetermined and fixed rates of speed, as follows:

T x P = n degrees

1 x 8 = 82.5 degrees

1 x 4 = 75 degrees

1 x 3 = 71.25 degrees

1 x 2 = 63.75 degrees

1 x 1 = 45 degrees

2 x 1 = 26.25 degrees

3 x 1 = 18.75 degrees

4 x 1 = 15 degrees

8 x 1 = 7.5 degrees

where

T is the number of units of time, graphically plotted on the horizontal x-axis.

P is the number of units of price, graphically plotted on the vertical y-axis.

x is read as "by".n degrees specifies the slope of the Gann angle, measured in degrees.

Translating time by price into degrees assumes a square grid, where one unit of time on the x-axis takes up the same amount of horizontal space as the one unit of price on the y-axis takes up vertical space. For example, 1/16 of an inch might be set to one week of time on the horizontal x-axis, and 1/16 of an inch might be set to one dollar of price on the vertical y-axis. On such a proportionally scaled chart, the 1 x 1 geometric angle, which for every one unit of time rises one point in price, is a 45 degree angle.

How to Calculate Hexagon Chart Angles

1 equates to 360 degrees. Therefore .5 equates to 180 degrees and .25 to 90. (But just like the sq9 calcs., not exactly) let "a" be your number or price or whatever then a = 3n(n-1) your first step of course is to solve for n which is not as easy as taking the square root but almost. Remember the quadratic equation? n = (3 + (9 + 12*a)½)/6 lets say your number is 36 and you want to add 90 degrees 1. first find n n = (3 + (9 + 12*36)½)/6 = 4 (In case its not clear… we are taking the square root of the term (9 + 12*36) in the above equation) 2. since 1 => 360 degrees , .25 => 90 degrees adding that to the n = 4 gives 4.25 therefore your target becomes: a' = 3*4.25(4.25 -1) = 41.4 <- not quite 42 like it should be but close enough don't you agree? Remember… the Square of 9 (Futia) formula is: degrees = (180*P½ -225)*360 (degrees)

Gann's Angle trading

Constructing Gann AnglesBefore we begin, it is important to realize that this form of analysis - like most forms of technical analysis - is not set in stone but constructed out of empirical methods. Without further ado, here is the process used to construct a Gann angle:

- Determine the time units - This is one of the empirical processes. One common way to determine a time unit is to study the stock's chart and take note of distances in which price movements occur. Then, simply put the angles to the test and determine their accuracy. Most people use intermediate-term (such as one to three-month) charts for this as opposed to long-term (multi-year) or short-term (one to seven-day) charts. This is because, in most cases, the intermediate-term charts produce the optimal amount of patterns.

- Determine the high or low from which to draw the Gann lines - This is the second empirical process, and the most common way to accomplish it is to use other forms of technical analysis--such as Fibonacci levels or pivot points. Gann himself, however, used what he called "vibrations" or "price swings." He determined these by analyzing charts using mathematical theories like Fibonacci.

- Determine which pattern to use - The two most common patterns are the 1x1 (left figure above), the 1x2 (right figure above), and the 2x1. These are simply variations in the slope of the line. For example, the 1x2 is half the slope of the 1x1. The numbers simply refer to the number of units.

- Draw the patterns - The direction would be either downward and to the right from a high point, or upward and to the right from a low point.

- Look for repeat patterns further down the chart – Remember this technique is based on the premise that markets are cyclical.

Again, this requires some fine-tuning with experience in order to perfect. Because of this, the results will vary from person to person. Some people, like Gann, will experience extraordinary success, while others - who don't use such refined techniques - will experience sub-par returns. However, if the system is followed and sufficient research is put into finding the optimal requirements, above-average returns should be attainable. But remember, technical analysis is an odds game -add more technical indicators to increase your chances of a successful trade.

Using Gann AnglesGann angles are most commonly used as support and resistance lines. But many studies have support and resistance lines. What makes this one so important? Well, Gann angles let you add a new dimension to these important levels - they can be diagonal.

Here you can see how Gann angles can be used to form support and resistance levels. Diagonal trendlines are commonly used to determine times to add to existing long positions, to determine new lows and highs (by finding significant breaks of the trend line), and to help discern the overall trend.

Using Gann AnglesGann angles are most commonly used as support and resistance lines. But many studies have support and resistance lines. What makes this one so important? Well, Gann angles let you add a new dimension to these important levels - they can be diagonal.

Here you can see how Gann angles can be used to form support and resistance levels. Diagonal trendlines are commonly used to determine times to add to existing long positions, to determine new lows and highs (by finding significant breaks of the trend line), and to help discern the overall trend.

Reference http://www.investopedia.com/articles/technical/04/042804.asp#ixzz2CNm7rj00

Gann's use of angles

Gann's used three patterns to predict market behavior in the future

1. Price study- This uses support and resistance lines, pivot points and angles.

2. Time study — This looks at historically reoccurring dates derived from natural order that Gann believed governed market movement.

3. Pattern study — This studies trends using trend lines and reversal patterns.

Using Gann angles requires practice and experience and below we have outlined tha basics that anyone using Gann angles should keep in mind.

Firstly, determine time units.

The way to determine a time unit is to study charts and look at the distances in which significant price movements occur.

Put the angles to the test and see how they perform.

The intermediate time period ( 1 — 3 months) tends to produce the highest number of accurate patterns and is the time frame to trade.

Secondly, a trader needs to determine the high or low from which to draw the Gann lines

Here you can use Fibonacci levels or pivot points to help you get an accurate picture . Gann then looked for "vibrations" or "price swings."

Finally, you need to know which pattern to use:

The most common patterns are the 1x1, the 1x2, and the 2x and are purely differences in the slope of the line.

The 1x2 is half the slope of the 1x1.

The numbers simply indicate the number of units and the slope of the line.

Traders need to look for patterns to trade.

The direction of the slope will be either down and to the right from a high point or up and to the right, if it's a low point.

Always look for repeat patterns on the charts.

Gann' theories are based upon the cyclical in nature of market movement, so the easier the patterns are to spot the more likely they will be tradable for profit.

Using Gann Angles for Trading Profits

Gann angles are a fantastic tool for predicting support and resistance levels.

Of course, many other trading methods use support and resistance lines however Gann angles add a new dimension, simply because they are diagonal.

The best Gann Formation

Will indicate a balance between time and price.

This will occur when prices move in synch with time.

This is present when the Gann angle being studied is at exactly 45 degrees.

In total there are nine different Gann angles that can be applied.

When one line is broken, the following angle will then give the next area of support or resistance.

Gann angles are just one of the tools He used to amass a fortune trading other include, the Golden ratio, Fibonacci numbers — when combined you have a powerful proven trading method.

As markets are cyclical and human nature never changes Gann's methods still apply today and are used by many savvy traders.

Gann made millions from Gann angles and the tools above study his methods further and see what they can do for your trading and you may be glad you did.

Gann's

W D Gann'S was trader of early 19th century Who invented this trading Method.He invented How Price , time and pattern moves in future, This is named as gann"s theory.

Gann's strategies revolved around three general areas of prediction:

Here Some terms are Used

Gann's strategies revolved around three general areas of prediction:

- Price study– This uses support and resistance lines, pivot points and angles.

- Time study – This looks at historically reoccurring dates, derived by natural and social means.

- Pattern study – This looks at market swings using trendlines and reversal patterns.

Ganns angle

Ganns grid

Gann"s square of Nine

Elliott wave Price target

Impulse Wave Price Targets

Price targets cannot only be set based on support and resistance lines, but also by using trend channels and Fibonacci projections. Remember that even the Elliott wave counts 5+3=8 are all Fibonacci numbers.

That is why all further wave subdivisions also are Fibonacci numbers.

That is why all further wave subdivisions also are Fibonacci numbers.

Price Target for Wave 1

| wave 1 price target |

The most common, wave1, the start of a new impulse wave, retraces between 23.6% and 38.2% of the complete previous correction wave . Even 50% is possible but rare.

Price Target for Wave 2

| wave 2 price target. |

Wave (2) retraces a minimum 38.2% of wave (1) ; however, most of the retracements are between 50% and 61.8%.

Even 100% retracement is possible and still complies with the Elliott rules.

Price Target for Wave 3

Price target for wave 3.

Looking at figure above once correction wave 2 is completed, you can draw an uptrend line from the start of wave 1 through the end of wave 2.

Next, you draw a parallel line with this trend line through the top of wave 1. Now you have a trend channel. The upper side of this channel is the first price target for wave 3.

If the price does not reach the upper side of this channel anymore, you probably are looking at a wave C, not a wave 3.

You should keep a horizontal support through the endpoint of wave 2. If the price falls through this level, wave 2 is not finished and will become more complex, and wave 3 has not yet started.

Impulse wave 3 often is the wave with the biggest move. So, usually, wave 3 will move up above the trend channel. In a rising impulse wave, it is common for the price to reach 161.8% of wave 1. In a falling impulse wave, wave 1 usually will reach 123.6%.

Price Target for Wave 4

| wave 4 price target |

At the end of wave 3 in figure above, you can draw a trend line through the tops of waves 1 and 3. Now draw a parallel line through the bottom of wave 2. You now have a trend channel of which the lower side is the primary target for wave 4. Not reaching the lower side of this channel probably means that there is a strong trend and that you are still in wave 3, or there is only a short wave 5 to be expected.

Looking at Fibonacci levels, wave 4 usually retraces back to 23.6% and to 38.2% of wave 3. Most of the time, this will be in the price area of sub-wave 4 of impulse wave 3.

Price Target for Wave 5

Quite often you will see a wave 5 that is equal to wave 1, or 61.8% to 76.4% of wave 3. If there is a wave 5 extension, then wave 5 is commonly 161% of wave 3, or 161% of the sum of waves 1 and 3.

Looking at trend channels, there are two possible methods you can apply:

Looking at trend channels, there are two possible methods you can apply:

Method 1

Price target for wave 5, method 1.

At the end of wave 4 in figure above, draw a trend line through the end of wave 2 and wave 4. Draw a parallel line through the top of wave 3. The upper side of this trend channel is the target for wave 5.

However, most of the time, this target will not be reached by wave 5, except when there are extensions in the making of wave 5, or when wave 3 was weak with just a moderate move.

Method 2

Usually, wave 3 has the highest acceleration compared to waves 1 and 5.

Usually, wave 3 has the highest acceleration compared to waves 1 and 5.

Price target for wave 5, method 2.

If wave 3 makes a bigger, sharp up-move like in figure 7.31, draw the basic trend line through the end of waves 2 and 4, but draw the parallel line through the top of wave 1.

This line will cross wave 3 and give a more moderate target for wave 5.

This line will cross wave 3 and give a more moderate target for wave 5.

Correction Waves Price Targets

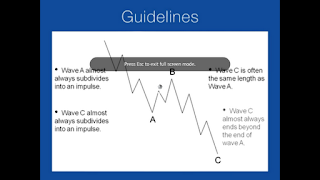

Price Target for Wave A

Wave A in a zigzag correction will, most of the time, retrace 38.2% and 50% of the previous 5 wave.

Price Target for Wave B

Wave B in a zigzag correction mostly retraces 38.2% of wave A.

In a flat correction, this will be 100%.

A triangle correction will take back 90% to 100% of wave A.

An inverted widening triangle retraces commonly 61.8% of wave A.

In a flat correction, this will be 100%.

A triangle correction will take back 90% to 100% of wave A.

An inverted widening triangle retraces commonly 61.8% of wave A.

Price Target for Wave C

Wave C will, many times, equal wave A.

Wave C is a minimum 61.8% of wave A.

In a double zigzag, this is commonly 138.2% of wave W.

In a flat or double flat correction, this often is 138.2% of wave A, or wave Y, respectively.

Wave C in a triangle is generally 76.4% of wave B.

For an inverted widening triangle, this is commonly 123.6% of wave B.

Wave C is a minimum 61.8% of wave A.

In a double zigzag, this is commonly 138.2% of wave W.

In a flat or double flat correction, this often is 138.2% of wave A, or wave Y, respectively.

Wave C in a triangle is generally 76.4% of wave B.

For an inverted widening triangle, this is commonly 123.6% of wave B.

Price Targets for Waves D and E

Price targets for waves D and E.

In figure above, at the end of wave B, draw a trend line through the beginning of wave A and the end of wave B.

You now can see a target for wave D, anticipating that a triangle correction is developing.

You now can see a target for wave D, anticipating that a triangle correction is developing.

You will get a confirmation at the end of wave C.

At the end of wave C, draw a line through the end of wave A and wave C. You now can see the target for wave E. Many times, wave E will not reach this trend line; conversely, it may pass it very shortly, next continuing the basic trend.

At the end of wave C, draw a line through the end of wave A and wave C. You now can see the target for wave E. Many times, wave E will not reach this trend line; conversely, it may pass it very shortly, next continuing the basic trend.

Price Target for Wave X

Wave X of a double zigzag, a double flat correction, or a triple zigzag is, most of the time, 50% of wave W. In a triple flat correction, this will be 76.4% of wave W.

Price Target for a Double Zigzag

Drawing a price trend channel, it is a good idea to distinguish a double zigzag from an impulse wave .

Both have about the same characteristics.

However, double zigzags fit almost perfect within the price channel. On the other hand, if it is a wave 3, remember that a wave 3 mostly will break this channel, being the bigger, more accelerating move.

Both have about the same characteristics.

However, double zigzags fit almost perfect within the price channel. On the other hand, if it is a wave 3, remember that a wave 3 mostly will break this channel, being the bigger, more accelerating move.

Price target for a double zigzag.

Courtesy :http://stocata.org/ta_en/elliott7.html

How Much wave 5 retrace ,Elliott wave

After Completion of 5th wave the total wave acts just like wave 1,

It will retrace upto 61.8% of total wave if trend continue.

That is after completion of wave five total wave acts like wave 1 if trend continues.

Retrace 61.8-78.2 % of total wave not more than wave 1,

So wave 5 will retrace upto wave 4 Extreme of that cycle if trend continue, If it breaks extreme of 4th wave

trend will change on that time frame.

So wave 4 acts important Support and resistance in trending market.

Elliott wave Time relationship

Elliott wave Time relationship

Wave 1:

TIME

Impulse W.1 usually overbalances in time the prior counter trend swing.

Wave 2:

TIME

> 50% W.1 minimum

> 62% < 162% of W.1 most likely

Wave 3:

TIME

W.3 almost always longer in time than W.1

W.3 often equal in time to complete W.0 through W.2 sequence.

Wave 4:

TIME

W.4 most often related to W.3 or W.0 - W.3

Often longer in time than W.3 / W.0 - W.3

W.4 138% - 162% of Parallel Projection of ends of W.1 - W.3 measured from beginning of W.2

Wave 5:

TIME

W.5 > W.4 if W.4 is a simple ABC

W.5 < W.4 if W.4 is complex

Wave A:

NA

Wave B:

TIME

> 50% < 100% of W.A time

Wave C:

TIME

Use Time guidelines for complete A-B-C corrective pattern.

Wave 1:

TIME

Impulse W.1 usually overbalances in time the prior counter trend swing.

Wave 2:

TIME

> 50% W.1 minimum

> 62% < 162% of W.1 most likely

Wave 3:

TIME

W.3 almost always longer in time than W.1

W.3 often equal in time to complete W.0 through W.2 sequence.

Wave 4:

TIME

W.4 most often related to W.3 or W.0 - W.3

Often longer in time than W.3 / W.0 - W.3

W.4 138% - 162% of Parallel Projection of ends of W.1 - W.3 measured from beginning of W.2

Wave 5:

TIME

W.5 > W.4 if W.4 is a simple ABC

W.5 < W.4 if W.4 is complex

Wave A:

NA

Wave B:

TIME

> 50% < 100% of W.A time

Wave C:

TIME

Use Time guidelines for complete A-B-C corrective pattern.

Thursday, November 15, 2012

Triangles elliott wave

Elliott wave triangle is side way market.

Key feature of triangle:

Main difference:

Key feature of triangle:

- volume and volatality will decrease

|

| look traingle Here volume and volatality decreased simultaneously. |

Main difference:

- Here volatality and Volume will decrease but

- volume and volatality will not decrease in diagonal

- Consist of 5 overlapping abcde pattern

- 3-3-3-3-3-3 structure.

- Occurs in wave 4 and wave B

- that is before final actionary wave

- Formed by connection of BD, AC

Ending diagonal:

Characters:

Where it can be found:

wave 5/ C

previously diagonal was named as diagonal triangle but now changed.

- It is most dynamic elliott wave pattern.

- It is termination pattern.

- It is motive wave, subdivided into 5 waves.

- It ushers( one who help other) trend reversal.

- It is in the direction of main trend.

- It is 33333 pattern.

- wave 4 moves within the territory of wave 1.

|

| Ending diagonal. five wave subdivide into 3 each wave, indicates reversal. |

Where it can be found:

wave 5/ C

previously diagonal was named as diagonal triangle but now changed.

Wednesday, November 14, 2012

How to differentiate traingle from Diagnonal

Triangle:

Where it can be found:

it is usually found in wave 4, B, X

So it is found in side way market

Never 2/A wave

most interesting it forms channel also.

Some characters:

Consist of 5 wave

wave 4, 1 overlap

wave 4 can never go beyond the origin of wave 3

wave 3 can not be shortest one amoung 1, 3, 5

Here

trend line of A, C

and trend line of B,D makes the triangle

A diagonal is also 5 wave pattern

it is also two type

starting diagonal

Ending diagonal

Where it found:

Staring diagonal

is made up of 5 wave, 5 3 5 3 5 pattern

Found in 1,A wave

Some characters:

Ending diagonal:

where it can be found:

wave 5/C

- A triangle is made up of 5 wave.

- each wave subdivided into 3 wave

- So our wave structure is 3 3 3 3 3

- Each sub wave is corrective pattern

- here in triangle five wave is marked by

- a=1

- b=2

- c=3

- d=4

- e=5

- Some occasion wave 1 may be largest, some times wave 5 may be largest

- When wave 1 largest it is contracting triangle

- when wave 5 largest it is expanding triangle.

- market can be bull or bear in contracting or expanding triangle.

Where it can be found:

it is usually found in wave 4, B, X

So it is found in side way market

Never 2/A wave

most interesting it forms channel also.

Some characters:

Consist of 5 wave

wave 4, 1 overlap

wave 4 can never go beyond the origin of wave 3

wave 3 can not be shortest one amoung 1, 3, 5

Here

trend line of A, C

and trend line of B,D makes the triangle

A diagonal is also 5 wave pattern

it is also two type

starting diagonal

Ending diagonal

Where it found:

Staring diagonal

is made up of 5 wave, 5 3 5 3 5 pattern

Found in 1,A wave

Some characters:

- here wave 1, 4 overlaps

- wave 1,3 make a trend line

- and wave 2, 4 makes another which converge

- Volume tends to decrease or diminish when diagonal forms

- wave 4 can not go beyond the origin of wave 3

- wave 3 can never be shorter amoung 1,3,5

- Internally wave 1,3,5 have impulse pattern

- wave 5 shortest

- wave 1 is the longest

- wave 2, 4 alteration can be happen.

Ending diagonal:

- Properties same as starting diagonal

- But here each wave is subdivided into three wave giving rise to 33333 pattern.

- rest all properties are same

- here wave 1, 4 overlaps

- wave 1,3 make a trend line

- and wave 2, 4 makes another which converge

- Volume tends to decrease or diminish when diagonal forms

- wave 4 can not go beyond the origin of wave 3

- wave 3 can never be shorter amoung 1,3,5

- Internally wave havecorrective pattern

where it can be found:

wave 5/C

Friday, November 9, 2012

Elliott wave pattern: Triangle

Elliott wave pattern: Triangle

it is correction pattern

Seen in wave 4 , but can be seen in wave 2 also

Consist of five wave abcde

Types:

1. Contracting triangle:

Rules and guidelines

In which wave

Internal structure

it is correction pattern

Seen in wave 4 , but can be seen in wave 2 also

Consist of five wave abcde

Types:

- Contracting triangle

- Expanding triangle

1. Contracting triangle:

Description

A triangle is a corrective pattern, which can contract or expand. Furthermore it can ascend or descend. It is composed of five waves, each of them has a corrective nature.

o It is composed of 5 waves.

o Wave 4 and 1 do overlap.

o Wave 4 can’t go beyond the origin of wave 3.

o Wave 3 cannot be the shortest wave.

o Internally all waves of the diagonal have a corrective wave structure.

o In a contracting Triangle, wave 1 is the longest wave and wave 5 the shortest. In an expanding Triangle, wave 1 is the shortest and wave 5 the longest.

o Triangles normally have a wedged shape, which follows from the previous.

o As a guideline the internal wave structure should show alternation.

Triangles occur only in waves B, X and 4. Never in wave 2 or A.

It is composed of five waves, of which the internal structure is 3-3-3-3-3.

2, Expanding triangle:

for more visit

Elliott wave pattern- Zigzag

Elliott wave pattern- Zigzag( correcting wave pattern)

it is sharp correction

Occurs in wave 2 usually

It is 5 3 5 wave pattern

Description

A Zigzag is the most common corrective structure, which starts a sharp reversal. Often it looks like an impulsive wave, because of the acceleration it shows. A zigzag can extend itself into a double or triple zigzag, although this is not very common, because it lacks alternation (the same two patterns follow each other). Notice that the zigzag can only be the first part of a corrective structure.

Rules and guidelines

o It is composed of 3 waves.

o Waves A and C are impulses, wave B is corrective.

o The B wave retraces no more then 61.8% of A.

o The C wave must go beyond the end of A.

o The C wave normally is at least equal to A.

In which wave

Most of the time it happens in A, X or 2. Also quite common in B waves as a part of a Flat, (part of) Triangles and sometimes in 4.

Internal structure

A single Zigzag is composed of 3 waves, a double of 7 waves separated by an X wave in the middle, a triple of 11 waves separated by two X waves (see pictures below). The internal structure of the 3 waves is 5-3-5 in a single Zigzag, 5-3-5-3-5-3-5 in a double.

Example of a Double Zigzag

for more information visit http://www.elliottwave.com/grpcontent/patterns/zigzags.aspx

Elliott wave pattern- Diagonal( correcting wave pattern)

Elliott wave pattern- Diagonal( correcting wave pattern)

There are two form of diagonal triangle

1.Diagonal triangle type1/ Ending diagonal triangle

Description

Diagonals are sort of impulsive patterns, which normally occur in terminal waves like a fifth or a C wave. Don’t confuse them with corrective triangles.

Diagonals are relatively rare phenomena for large wave degrees, but they do occur often in lower wave degrees on intra-day charts. Usually Diagonal triangles are followed by a violent change in market direction.

Rules and guidelines

The most important rules and guidelines are:

o It is composed of 5 waves.

o Waves 4 and 1 do overlap.

o Wave 4 can’t go beyond the origin of wave 3.

o Wave 3) cannot be the shortest wave.

o Internally all waves of the diagonal have a corrective wave structure.

o Wave 1 is the longest wave and wave 5 the shortest.

o The channel lines of Diagonals must converge.

o As a guideline the internal wave structure should show alternation, which means different kind of corrective structures.

In which wave

Diagonal triangles type 1 occur in waves 5, C and sometimes in wave 1.

Internal structure

The internal structure of the five waves is 3-3-3-3-3.

2,Diagonal triangle type 2/ Starting/leading diagonal triangle

Description

Diagonal type 2 is a sort of impulsive pattern, which normally occurs in the first or A wave. The main difference with the Diagonal Triangle type 1 is the fact that waves 1, 3 and 5 have an internal structure of five waves instead of three. Experience shows it can also occur in a wave 5 or C, though the Elliott Wave Principle does not allow this. Don’t confuse this with corrective triangles.

Diagonals are relatively rare phenomena for large wave degrees, but they do occur often in lower wave degrees in intra day charts. These Diagonal triangles are not followed by a violent change in market direction, because it is not the end of a trend, except when it occurs in a fifth or a C wave.

Rules and guidelines

The most important rules and guidelines are:

o It is composed of 5 waves.

o Wave 4 and 1 do overlap.

o Wave 4 can’t go beyond the origin of wave 3.

o Wave 3) cannot be the shortest wave.

o Internally waves 1, 3 and 5 have an impulsive wave structure.

o Wave 1 is the longest wave and wave 5 the shortest.

o As a guideline the internal wave structure should show alternation, which means that wave 2 and 4 show a different kind of corrective structure.

In which wave

Diagonal triangles type 2 occur in waves 1 and A.

Internal structure

The five waves of the diagonal type 2 show an internal structure of 5-3-5-3-5.

for details visithttp://www.elliottwave.com/grpcontent/patterns/diagonals.aspx

There are two form of diagonal triangle

- Diagonal triangle type1/ Ending diagonal triangle

- Diagonal triangle type 2/ Starting/leading diagonal triangle

1.Diagonal triangle type1/ Ending diagonal triangle

Description

Diagonals are sort of impulsive patterns, which normally occur in terminal waves like a fifth or a C wave. Don’t confuse them with corrective triangles.

Diagonals are relatively rare phenomena for large wave degrees, but they do occur often in lower wave degrees on intra-day charts. Usually Diagonal triangles are followed by a violent change in market direction.

Rules and guidelines

The most important rules and guidelines are:

o It is composed of 5 waves.

o Waves 4 and 1 do overlap.

o Wave 4 can’t go beyond the origin of wave 3.

o Wave 3) cannot be the shortest wave.

o Internally all waves of the diagonal have a corrective wave structure.

o Wave 1 is the longest wave and wave 5 the shortest.

o The channel lines of Diagonals must converge.

o As a guideline the internal wave structure should show alternation, which means different kind of corrective structures.

In which wave

Diagonal triangles type 1 occur in waves 5, C and sometimes in wave 1.

Internal structure

The internal structure of the five waves is 3-3-3-3-3.

2,Diagonal triangle type 2/ Starting/leading diagonal triangle

Description

Diagonal type 2 is a sort of impulsive pattern, which normally occurs in the first or A wave. The main difference with the Diagonal Triangle type 1 is the fact that waves 1, 3 and 5 have an internal structure of five waves instead of three. Experience shows it can also occur in a wave 5 or C, though the Elliott Wave Principle does not allow this. Don’t confuse this with corrective triangles.

Diagonals are relatively rare phenomena for large wave degrees, but they do occur often in lower wave degrees in intra day charts. These Diagonal triangles are not followed by a violent change in market direction, because it is not the end of a trend, except when it occurs in a fifth or a C wave.

Rules and guidelines

The most important rules and guidelines are:

o It is composed of 5 waves.

o Wave 4 and 1 do overlap.

o Wave 4 can’t go beyond the origin of wave 3.

o Wave 3) cannot be the shortest wave.

o Internally waves 1, 3 and 5 have an impulsive wave structure.

o Wave 1 is the longest wave and wave 5 the shortest.

o As a guideline the internal wave structure should show alternation, which means that wave 2 and 4 show a different kind of corrective structure.

In which wave

Diagonal triangles type 2 occur in waves 1 and A.

Internal structure

The five waves of the diagonal type 2 show an internal structure of 5-3-5-3-5.

for details visithttp://www.elliottwave.com/grpcontent/patterns/diagonals.aspx

Thursday, November 8, 2012

How to Spot market Reversal

There are many way to spot market Reversal:

- Trend line Break

- Fibbos angle, retracement

- Candlestick pattern( reversal)

- Tradition chart pattern( Head and shoulder, Inverse head and shoulder, Double tops,bottoms,Tripple tops and bottoms)

- Divergence trading

Continuation pattern:

- Candlestick pattern

- Triangle

- Rectangle

- Flags

- Pennants

How to Spot market Reversal

There are many way to spot market Reversal:

- trend line Break

- Fibbos angle, retracement

- Candlestick pattern( reversal)

- Tradition chart pattern( Head and shoulder, Inverse head and shoulder, Double tops,bottoms,Tripple tops and bottoms)

- Divergence trading

How to Spot market Reversal

There are many way to spot market Reversal:

trend line Break

Fibbos angle, retracement

Candlestick pattern( reversal)

Tradition chart pattern( Head and shoulder, Inverse head and shoulder, Double tops,bottoms,Tripple tops and bottoms)

Divergence trading

trend line Break

Fibbos angle, retracement

Candlestick pattern( reversal)

Tradition chart pattern( Head and shoulder, Inverse head and shoulder, Double tops,bottoms,Tripple tops and bottoms)

Divergence trading

How to Spot market Reversal

There are many way to spot market Reversal:

trend line Break

Fibbos angle, retracement

Candlestick pattern( reversal)

Tradition chart pattern( Head and shoulder, Inverse head and shoulder, Double tops,bottoms,Tripple tops and bottoms)

trend line Break

Fibbos angle, retracement

Candlestick pattern( reversal)

Tradition chart pattern( Head and shoulder, Inverse head and shoulder, Double tops,bottoms,Tripple tops and bottoms)

How to Spot market Reversal

There are many way to spot market Reversal:

trend line Break

Fibbos angle, retracement

Candlestick pattern( reversal)

Tradition chart pattern( Head and shoulder, Inverse head and shoulder)

trend line Break

Fibbos angle, retracement

Candlestick pattern( reversal)

Tradition chart pattern( Head and shoulder, Inverse head and shoulder)

Chart pattern trading /gartley pattrn

Gartley chart pattern:

it is consist of five limb

First limb , is the direction of major trend

Last limb(fifth limb) is along with major trend

The rest three limb is ABC correction

It is applicbale to all type of chart pattrn.

See the picture below

it is consist of five limb

First limb , is the direction of major trend

Last limb(fifth limb) is along with major trend

The rest three limb is ABC correction

It is applicbale to all type of chart pattrn.

See the picture below

How to trade with chart pattern:

Here outer trend line will be intacts, Inner trend line may break

Fibbos angle in strong support or resistance61.8%,76,84%

Types of gartley pattern, Bullish and Bearish

Wednesday, November 7, 2012

Anatomy of Elliott wave, patterns

Elliott wave pattern in impulsive and corrective wave

These pattern also helps to identify counting Elliott wave.

Wave 1 pattern may be

Wave 2 pattern may be

Wave 3 pattern

Wave 4 pattern

Wave 5. patterns

A wave patterns

It is usually made up of five sub wave, But three sub wave may be found.That is why if we get 3 wave we have to wait till fifth,

B wave pattern

C wave pattern:

It is consist of five sub wave a=1,b=2,c=3,d=4,e=5

Wave may overlaped and ateration may occur.

These pattern also helps to identify counting Elliott wave.

Wave 1 pattern may be

- Extension wave pattern

- impulse 1 patterntern

- impulse 2 pat

- Starting wedge/diagonal type 2

Wave 2 pattern may be

- Sharp correction(zigzag)

- Side way correction( Doubles, tripples, triangle) all these made with zigzag, flat,irregular pattern

|

| Triangle Where it can be found: Wave 4, but wave 2 some times |

Wave 3 pattern

- Extension pattern

- Impulse 1 pattern

Wave 4 pattern

- Side way correction usually occurs

- Some times Sharp correction occurs.

- Lies within parallel lines

Wave 5. patterns

- Impulse 1

- Impulse 2

- Extension pattern

- Truncated

- Ending wedge/diagonal type 1

|

| Truncated/5th wave failure Where it can be found: Wave 5, C |

A wave patterns

It is usually made up of five sub wave, But three sub wave may be found.That is why if we get 3 wave we have to wait till fifth,

- Impulsive wave pattern 2

- Diagonal type 2

- Impulsive triangle may form

- price 38-50% of wave 5

- Here momentum is large, but wave c show small momentum which makes divergence.

B wave pattern

- Flat.Zigzag, Irregular pattern,Double tops,bottoms, tripple tops, bottomx, wave pattern

- WXY,WXYxz pattern

C wave pattern:

It is consist of five sub wave a=1,b=2,c=3,d=4,e=5

Wave may overlaped and ateration may occur.

- Diagonal type 1/ Ending wedge

- truncated wave pattern

- Impulse 2 pattern

- Triangle may formed( Flat MACD around zero line)

- 60-162% of wave A

- 160-260% of wave B

- Never >161% of A, if so, counting is wrong

- Rarely >260% of wave B

- Divergence is formed MACD,RSI

|

| Impulse1pattern, Where It can be found:Wave 1,3,5 and A,C |

|

| Diagonal type1/Ending Diagonal/Wedge Where It can Be found: Wave 5, C |

|

| Diagonal type 2/Starting wedge Where It can be found: Wave 1 and A |

|

| Zigzag correction |

|

| Triangle |

|

| Extension pattern Where It can be found: Wave 1,3,5 may alterate, usually most common in wave 3 |

|

| Flat pattern |

|

| Impulse 2 pattern Where It can be found: Wave 1, A and C Never in wave 3 |

|

| triangle pattern, Where It can be found: wave 4(mostly), wave 2 some times, Wave b |

|

| Truncated/ 5th wave failure Where It can be found: wave 5 and C |

|

| WXY or combination |

|

| double zigzag |

|

| Zigzag flat |

Subscribe to:

Comments (Atom)